how to file taxes for coinbase

Find Coinbase Pro in the list of supported exchanges and select the import method you prefer. If you use the Coinbase tax reporting API with a crypto tax app - all your Coinbase transaction history will be automatically imported to your chosen app.

Information here is provided to help you understand your taxes but should be reviewed before you use it to file your taxes.

. Crypto can be taxed in two ways. The Passphrase will not be shown again so be sure to copy it from this screen. The crypto exchange company said in a blog post that a new section in its app and website would help customers.

Staking rewards are treated like mining proceeds. As a Coinbase Wallet tax calculator Koinly is able to do a bunch of impressive tasks that save you time and can even save you from paying too much tax at tax time. You can automatically import your Coinbase Pro transactions using an API connection or import them manually through a CSV file.

Only select View. When required by the IRS the crypto exchange or broker you use including Coinbase has to report certain types of activity directly to the IRS using specific forms and provide you with a. If you are a big fish I would make sure to pay the taxes.

Navigate to your Coinbase account and find the option for downloading your complete transaction history. No Tax Knowledge Needed. Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations.

Do not select Transfer or Trade. Get help with all crypto taxes even transactions off Coinbase. This includes currency awarded through Coinbase Earn Staking or USDC Rewards.

Export Coinbase transaction history in a CSV file. Metamask Coinbase DeFi Tax Software. Safe Secure Always Free Federal Filing.

If your account is closed you can use CSV to import Coinbase transactions. ⁵Coinbase doesnt provide tax advice. Either as income a federal tax on the money you earned or as a capital gain a federal tax on the profits you made from selling certain assets.

If you earn 600 or more in a year paid by an exchange including Coinbase the exchange is required to report these payments to the IRS as other income via IRS Form 1099-MISC youll also receive a copy for your tax return. The Coinbase Card is issued by MetaBank NA Member FDIC pursuant to a license from Visa USA. Capture Your W-2 In A Snap And File Your Tax Returns With Ease.

You also have to complete transactions in cryptocurrency trading on the platform in the previous year equal to or exceeding 600 worth. Customers can use these amounts to prepare and file their taxes either with their personal accountants or directly with tax prep software like TurboTax. Please work with a professional.

The Coinbase Card is powered by Marqeta. How to Export a txf file from Coinbase Pro for TurboTax CD Desktop CoinTracker EasyTXF How Crypto Taxes Work on Coinbase FULL GUIDE Crypto Taxes Done in 10 Minutes. Crypto mined as a business is taxed as self-employment income.

Plus 10-15 on gains isnt that bad IMO. You can count on the IRS going back through your history. You can generate your gains losses and income tax reports from your Coinbase investing activity by connecting your account with CoinLedger.

Use the Coinbase tax report API with crypto tax software. So what counts as income. Ad E-File Your US.

E-File Directly to the IRS. Taxpayers may owe taxes on the amount they gained from crypto or may be able to use losses against their other income. Home of the Free Federal Tax Return.

How to do Your Coinbase Pro Cryptocurrency Taxes with Cointracker Crypto Taxes. Heres a roundup of all the ways you can earn on Coinbase. If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received.

Import all your trades including purchases sales swaps and rewards. Basically it is information that you have to add to your regular tax filings. This does not give us access to move your funds.

Within CoinLedger click the Add Account button on the top left. Click Continue with Coinbase. In short heres what Koinly can do for you.

Taxes are based on the fair. Copy the contents of the Passphrase field in Coinbase Pro and paste it into the Passphrase field on the Add Exchange Data screen in your open Ledgible browser window or tab. Coinbase wants to help customers file cryptocurrency taxes for the 2021 tax year.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Connect your account by importing your data through the method discussed below. You can see the full instructions on how to integrate Coinbase Koinly here.

Keep in mind that the IRS and Coinbase are currently in a disagreement about whether or not Coinbase needs to turn over all major data about its users. In order to receive Form 1099 you have to be an account-holder on Coinbase in the US or US tax-compliant areas. You dont have to file a Coinbase tax return you have to use the 1099 that was provided by Coionbase to complete your taxes.

Tax Return Directly to the IRS. This will redirect you to Coinbase to grant CoinTracker read-only access to your account. Learn From My Mistakes.

Convert your transactions into your countrys currency at. If you are also a Coinbase Pro formerly GDAX user please note that adding your Coinbase account.

Forbes Tech On Twitter Bitcoin Cryptocurrency Trading Bitcoin Mining

Coinbase Learn How To Set Up A Crypto Wallet Youtube In 2022 Learning Wallet Setup

Coinbase Est Desormais Votre Guide Personnalise Des Taxes Cryptographiques Par Coinbase Janvier En 2022 Personnalise Chef De Produit Investir En Bourse

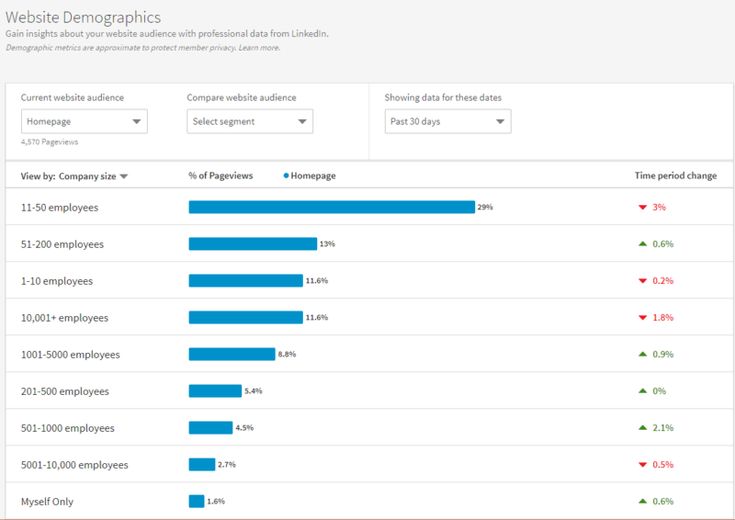

How To Make The Most Of The Demographics Of Linkedin S Free Website Free Website Demographics Business Website

Here Is Your Sign To Pick Up A New Read From Your Local Bookseller Besides Being A Fantastic Way To Esca Book Recommendations Content Creation Body Positivity

Cryptocurrency Tax Tips Until Tax Relief Passes Expert Blog Crypto News Bitcoin Regulation Coinbase Cryptocurrency Cryptocurrency News Bitcoin Mining Software

Product Hunt Launches Digestion Application Of New Techniques Without Spam Sip Digestion Product Launch Application

Coinbase Users Will Be Able To File Tax Reports By The Coin Tracker Service In 2021 Filing Taxes Bitcoin Account Coins

Cartesi Is Now On Coinbase Earn Earnings Cryptocurrency News Bitcoin Currency

Coinbase Insta A Sus Usuarios A Pagar Impuestos Sobre Ganancias En Bitcoin Filing Taxes Income Tax Tax Brackets

Data Driven Digital Team With Growth Hacking Core

Pin On Small To Medium Business

Ontology Weekly Report June 18 Ontologynetwork Technical Documentation Founding Fathers Future Plans

Wealthsimple Smart Investing Investing Money Money Saving Strategies Money Strategy

Coinbase Users Will Be Able To File Tax Reports By The Coin Tracker Service In 2021 Filing Taxes Bitcoin Account Coins