when will i get my minnesota unemployment tax refund

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Tax rate for new employers.

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

However many people have experienced refund delays due to a number of reasons.

. 2022 Tax rate factors. Base Tax Rate for 2022 from 050 to 010. If you arent aware of the tax rule change in Minnesota the payments will come as a surprise.

The Minnesota Department of Revenue has confirmed the processing of returns impacted by recent tax changes for those who collected unemployment insurance compensation and Paycheck Protection Program loan forgiveness. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. How to get the tax refund.

Minnesota Department of Revenue. Up to 10200 of the benefits didnt count as income under the american rescue plan meaning taxpayers didnt have to pay federal tax on them. Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if.

Minnesota Unemployment Tax Refund. 24 and runs through April 18. Call the automated phone system.

The Taxable wage base for 2022 is 38000. The average refund for all processed returns is currently 584 according to the Minnesota Department of Revenue. Mail your property tax refund return to.

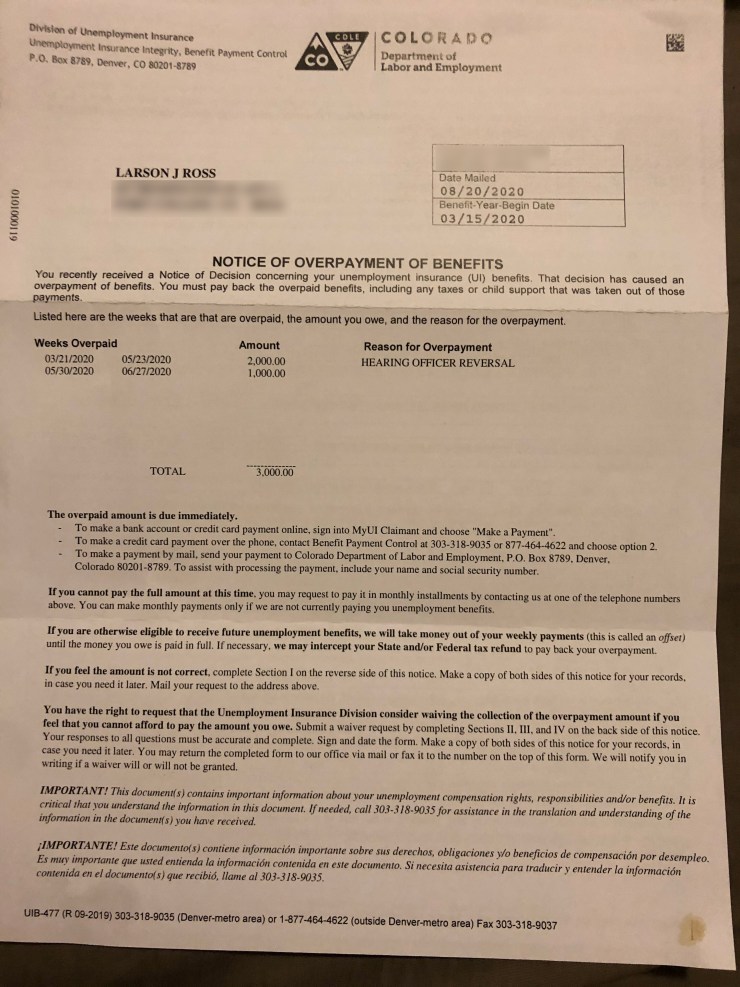

Why are you getting this. Minnesota Department of Revenue Individual Income Tax. The amount will be posted to the employers unemployment insurance account as a credit on July 1 2016.

This process is expected to be finished in early 2022 meaning some will have to wait until next year to get a refund. If youre due a refund from your tax year 2020 return you should wait to get it before filing Form 1040X to amend your original tax return. The Minnesota Department of Revenue announced last week that about 1000 refunds will go out this week a process that officials hope will ramp up to roughly 50000.

FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans. The amount of tax reduction available to an eligible employer between July 1 2016 and June 30 2017 will be a dollar amount equal to the ratio of taxes they paid in 2015 to the total amount of taxes all eligible employers paid in 2015. On September 13th the State.

Up to 10200 of extra unemployment benefits are also tax-free for people making less than 150000 per year. The Department of Labor has not designated their state as a credit. The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds.

Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. Minnesota Department of Revenue Mail Station 0020 600 N. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

About 500000 Minnesotans are in line to get. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. About 500000 Minnesotans are in line to.

By Anuradha Garg. In the latest batch of refunds announced in November however the average was 1189. 21 days or more since you e-filed.

A spokesman for the Minnesota Department of Revenue said taxpayers dont need to. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. They fully paid and paid their state unemployment taxes on time.

Mail to Minnesota employers on or before December 15 2021. Mail your property tax refund return to. If you have an expired property tax refund check we cannot reissue it.

Direct deposit refunds started going out Wednesday and paper checks today. Federal and MN State unemployment tax refund Sorry if this is a repeat. Additional Assessment for 2022 from 1400 to 000.

The new law reduces the. Federal and MN State unemployment tax refund. Check For the Latest Updates and Resources Throughout The Tax Season.

Paul MN 55145-0020 Mail your tax questions to. 22 2022 Published 742 am. Property tax refund checks are also valid for two years.

For this round the average refund is 1686. View step-by-step instructions for accessing your 1099-G by phone. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

Federal and MN State unemployment tax refund. Refund for unemployment tax break. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

When will I get the refund. If you received unemployment in 2020 and filed BEFORE Minnesota changed their law of taxing the unemployment income you may be getting a letter informing you that you will be receiving an additional refund. All 2022 Unemployment Insurance Tax Rate Determinations were sent out by US.

Mail to Minnesota employers on or before December 15 2021. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. It is estimated that more than 540000 Minnesotans are eligible for the COVID-19 tax refunds as a result of these tax cuts passed in.

People who received unemployment benefits last year and filed tax. Tax refunds are starting to go out Monday for Minnesotans who collected unemployment insurance or businesses that received federal loans during the height of the COVID-19 pandemic. Paul MN 55146-5510 Street address for deliveries.

If you received unemployment benefits in Minnesota before 2021 you can also view your previous 1099-G forms. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. However unemployment benefits received in 2020 and 2021 are exempt from tax. Minnesota Department of Revenue Mail Station 5510 600 N.

The Taxable wage base for 2022 is 38000. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Minnesota Department of Revenue Mail Station 0020 600 N.

If you have an expired income tax refund check mail it along with a written request to reissue it to. They have about 540000 refunds to issue and expect to do 1000 per week so it may take a while. However up to 508000 households have already - or will get - a refund before the end of the year.

The state of Minnesota had originally taxed the full amount of unemployment that you received in 2020. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax State News Voiceofalexandria Com

State Income Tax Returns And Unemployment Compensation

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Questions About The Unemployment Tax Refund R Irs

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Minnesota Business Taxes Spike After Legislature Misses Deadline Minneapolis St Paul Business Journal

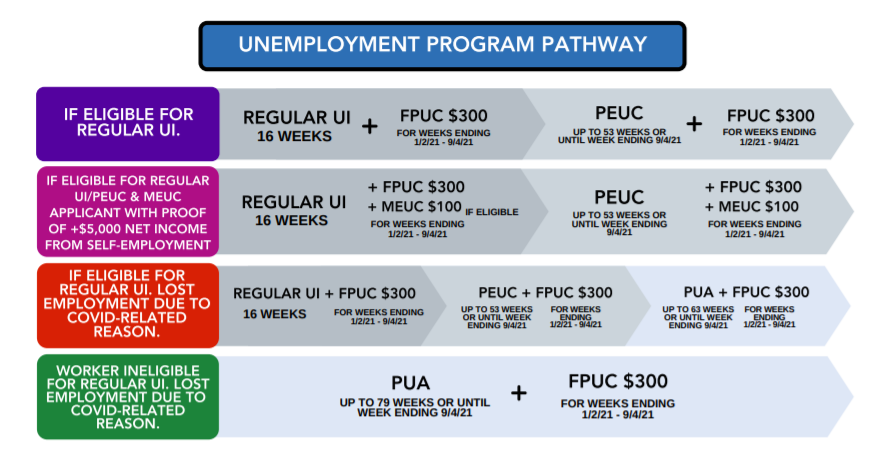

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

667k Minnesotans To Get Pandemic Hero Pay Business Unemployment Tax Increase Reversed Twin Cities

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned Netional Dastak

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Where S My Refund Minnesota H R Block

When Should Minnesotans Expect Tax Refunds Passed In The State Budget Star Tribune

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

When Will Irs Send Unemployment Tax Refunds Kare11 Com

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest