unlevered free cash flow vs fcff

Unlevered Free Cash Flow - UFCF. The formula below is a simple and the most commonly used formula for levered free cash flow.

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow FCFF Excel Template.

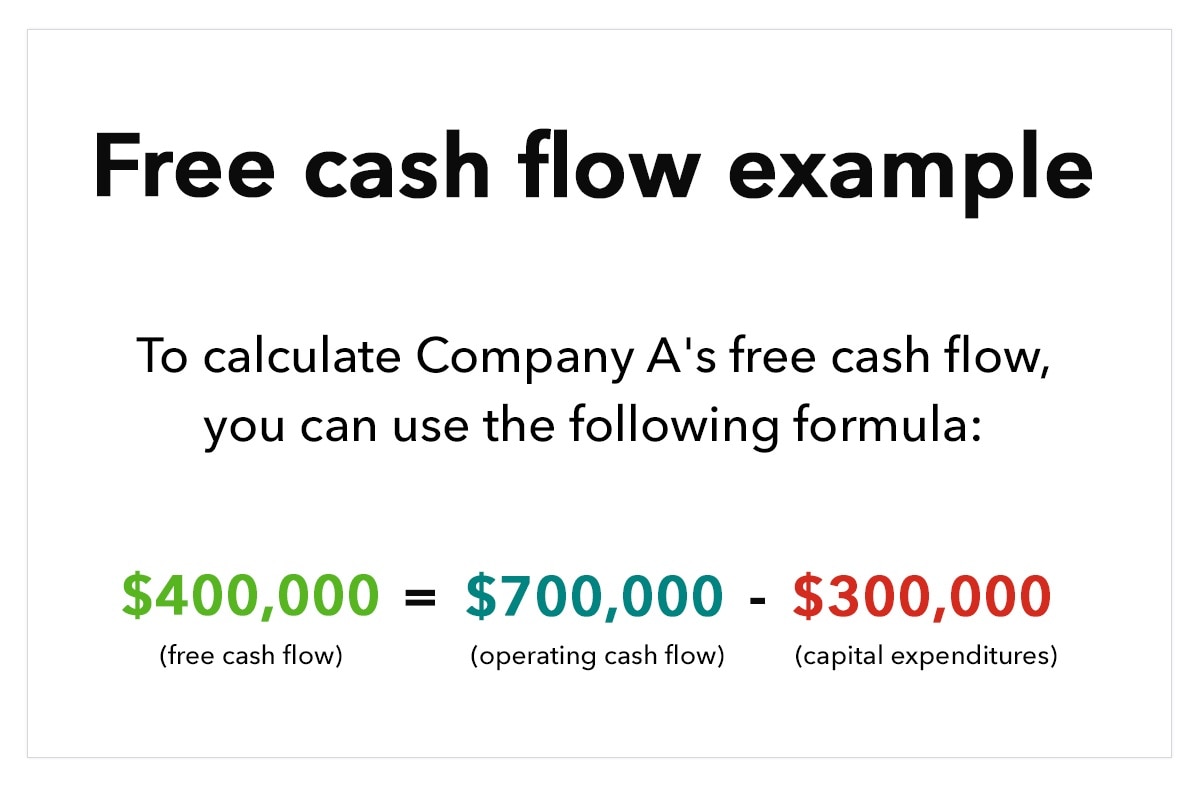

. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company. Free Cash Flow to Firm FCFF also referred to as Unlevered Free Cash Flow and Free Cash Flow to Equity FCFE commonly referred to as Levered Free Cash Flow. Free Cash Flow Operating Cash Flow CFO Capital Expenditures.

The FCFF and FCFE which are acronyms for Free Cash Flow for the Firm and Free Cash Flow to Equity are the two types of free cash flow measures. FCFF vs FCFE FCFF vs FCFE Existují dva typy volných peněžních toků. By Corporate Finance Institute.

If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115. The cash flow of an organization is ordinarily classified as cash flows from different business operations financing and investing. Calculate Free Cash Flow.

Unlevered FCF is FCF to the enterprise ie the firm. Free Cash Flow to Firm FCFF commonly referred to as Unlevered Free Cash Flow. Free Cash Flow to Firm FCFF refers to the cash generated by the core operations of a company that belongs to all capital providers both debt and equity.

Unlevered free cash flow vs fcff. This is the ultimate Cash Flow Guide to understand the differences between EBITDA Cash Flow from Operations CF Free Cash Flow FCF Unlevered Free Cash Flow or Free Cash Flow to Firm FCFF. There are a few techniques used to understand the cash flow of an organization including the debt service coverage.

It is an indicator of the companys equity capital management read more and free cash flow to firm free cash flow to firm fcff free cash flow to firm or unleveled cash flow is the cash remaining after depreciation taxes and other investment costs are paid from the revenue. Unlevered Free Cash Flow. FCFE because the numerator and discount rate of multiples largely depend on the methods of cash flow used.

This shows how good a small business is at generating cash. It is important to understand the difference between FCFF vs FCFE as the discount rate and numerator of valuation multiples. Most information needed to compute a companys FCF is on the cash flow statement.

Used interchangeably with unlevered free cash flow the FCFF metric accounts for all recurring operating expenses and re-investment expenditures while excluding all outflows related to lenders such as interest expense payments. There are various ways to compute for FCF although they should all give the same results. Free cash flow to the firm is synonymous with unlevered free cash flow.

A complex provision defined in section 954c6 of the US. Free cash flow is the cash that a company generates from its normal business operations before interest payments and after subtracting any. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

Free Cash Flow FCF is the amount of cash freely available to all capital providers. FCFF vs FCFE FCFF vs FCFE There are two types of Free Cash Flow. Unlevered free cash flow is used in both DCF valuations and debt capacity analysis and represents the total cash generated for both debt and equity holders.

FCFE Free Cash Flow to Equity Levered Free Cash Flow LFCF The value of a company if all debt was paid off. And Free Cash Flow to Equity FCFE or Unlevered Free Cash Flow vs Levered Free Cash Flow. Internal Revenue Code that lowered taxes for many US.

It is the cash flow available to all equity holders and. Analyze Unlevered Free Cash Flow. Unlevered free cash flow UFCF is a companys.

Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. It is vital to understand FCFF vs. Learn the formula to calculate each and derive them from an income statement balance sheet or statement of cash flows.

There are two types of Free Cash Flows. Take operating cash flows and subtract capital expenditures. And Free Cash Flow to Equity FCFE or Unlevered Free Cash Flow vs Levered Free Cash Flow.

The look thru rule gave qualifying US. Includes interest expense but NOT debt issuances or repayments. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made.

FCFF is not the same as CFO - CAPEX because Cash from operations starts with net income instead of NOPAT where NOPAT net operating profit after taxes is EBIT 1 - t. Calculate free cash flow from a statement of cash flows. Levered Free Cash Flow.

Free cash flow to the firm FCFF represents the amount of cash flow from operations available for distribution after certain expenses are paid. Excludes interest expense and ALL debt issuances and repayments. The difference between the two can be traced to the fact that Free Cash Flow to Firm excludes the impact of interest payments and.

Includes interest expense and mandatory debt repayments but. Unlevered free cash flow can be reported in a companys. FCFF vs FCFE.

This is a companys cash inflows before items like interest payments are factored in. Free Cash Flow vs. The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such that LFCF Net Profit DA ΔNWC CAPEX Debt and UFCF.

Used interchangeably with unlevered free cash flow the FCFF metric accounts for all recurring operating expenses and re-investment expenditures while excluding all outflows related to. Used to value equity with a Cost of Equity discount rate only if there are no bondholders andor preferred shareholders FCFF Free Cash Flow to Firm Unlevered Free Cash Flow UFCF The value of the entire firm or enterprise.

What Is Free Cash Flow And Why Is It Important Quickbooks

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff Cash Flow Statement Cash Flow Financial Statement Analysis

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Best Sale 53 Off Espirituviajero Com

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

How Are Cash Flow And Free Cash Flow Different

Cash Flow Formula How To Calculate Cash Flow With Examples

Unlevered Free Cash Flow Definition Examples Formula

This Is The Ultimate Cash Flow Guide To Understand The Differences Between Ebitda Cash Flow From Operations Cf In 2022 Cash Flow Cash Flow Statement Enterprise Value

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Ebitda Vs Cash Flow From Operations Vs Free Cash Flow

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial